WAVE Life Sciences (WVE)

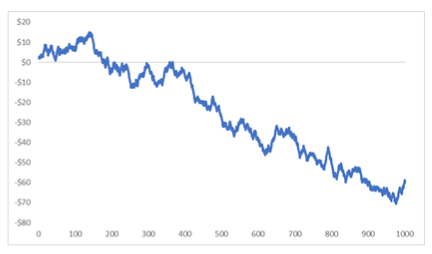

Over the next 13 weeks, WAVE Life Sciences has on average historically risen by 12.8% based on the past 2 years of stock performance.

WAVE Life Sciences has risen higher by an average 12.8% in 1 of those 2 years over the subsequent 13 week period, corresponding to a historical probability of 50%

The holding period that leads to the greatest annualized return for WAVE Life Sciences, based on historical prices, is 27 weeks. Should WAVE Life Sciences stock move in the future similarly to its average historical movement over this duration, an annualized return of 218% could result.

May 31st Daily Market Comments

The Dow continues to show indecisiveness but note that the low of Today supported right on the 50 day moving average. The NASDAQ is showing the most strength, currently trading positive after yesterday’s Doji gap up above the resistance level.