The Doji signal is one of the most revealing signals of the candlestick patterns. It clearly indicates that the Bulls and the Bears are at equilibrium or a state of indecision. When it appears at the end of an extended trend it has significant implications that the trend may be ending. The Japanese say that whenever this signal appears to always take notice. In other words, when a Doji appears at the top of a trend, especially in an overbought area, you should be prepared to close your trade. Conversely, when this signal is seen at the bottom of an extended downtrend, it requires buying signals the next day to confirm the reversal. Otherwise, the weight of the market could take the trend lower.

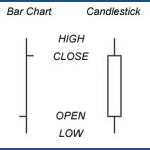

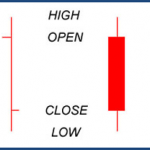

The Doji signal is comprised of one candle. It is formed when the open and the close occur at the same level or very close to the same level in a specific timeframe. This essentially creates a cross formation.

As the illustration above demonstrates, the horizontal line represents the open and close occurring at the same level. The vertical line represents the total trading range during that time. Upon seeing this signal in over-bought or oversold conditions, (over-bought or oversold conditions can be defined using other indicators such as stochastics); there becomes an extremely high probability reversal situation. When this signal appears it is demonstrating that there is indecision now occurring at an extreme portion of a trend. It is important to note that this indecision can be portrayed in a few variations.

Criteria for a Doji Signal

- The open and close are the same or nearly the same

- The length of the shadow should not be excessively long, especially when viewed at the end of a bullish trend.

Doji Signal Enhancements

- A gap away from the previous day’s close sets up for a stronger reversal move.

- Large volume on the signal day increases the chances that a blow-off day has occurred although it is not a necessity.

- It is more effective after a long candle body and is usually an exaggerated daily move compared to the normal daily trading range seen in the majority of the trend.

Recognizing and understanding the psychology that forms the major candlestick patterns will provide completely new insights for investors to understand optimal times to buy and sell. Japanese rice traders realized that prices do not move based on fundamentals but instead that they move based on the investor perception of those fundamentals. The Doji signal is one of the most predominant reversal indicators. It is very effective in all-time frames whether using a one-minute, five-minute, or fifteen-minute chart for day trading or daily, weekly, and monthly charts for the swing trader and long-term investor.

Continue to read about another signal called the Bearish Engulfing Signal.