The Hidden Dangers of Automatic Exercise

By Bill Johnson

Options strategies are highly rewarding, but like any field, there are rules and procedures you must understand. One of the most misunderstood – and potentially dangerous – is automatic exercise.

When you buy an option – call or put – you have the right, not the obligation, to exercise the option. If you exercise a call option, you’ll buy 100 shares of stock and pay the strike price. On the other hand, if you exercise a put option, you’ll sell 100 shares of stock and receive the strike price. You’re not required to ever exercise a long option. It’s simply a right if you choose. Most the time, options traders just close their options in the open market and take their profits that way. Still, some traders may want to buy or sell shares of stock by exercising an option, and they’re certainly free to do that.

However, there is a procedure set by the Options Clearing Corporation (OCC) that can potentially change that decision. If any option is at least one cent in the money, it is automatically exercised unless you instruct the broker to not do so. For example, let’s say you own the $100 call, and the stock closes at $100.01 or higher at expiration. If you didn’t close at call out at expiration, it will automatically be exercised, and that means you’re going to own 100 shares of stock on Monday morning. On the other hand, if you own a $100 put and the stock closes at $99.99 or lower, you’ll end up selling 100 shares of stock from your account. If you don’t have the stock in the account, you’ll be short 100 shares of stock. What if you don’t have to cash in the account to maintain the long or short stock positions?

Most brokers will still exercise the options, and you’ll owe at least a 50% margin requirement to continue holding the position. Some brokers, however, will close the position if you don’t have the cash, so it’s important to understand your broker’s policies.

Losing More Than What You Paid

The main danger with automatic exercise is that it creates the potential for you to lose more on the option than the amount you paid. You often hear that the most you can lose on an option is the amount you paid, and that means the option itself cannot have negative value. However, because of this man-made rule of automatic exercise, it’s not totally true.

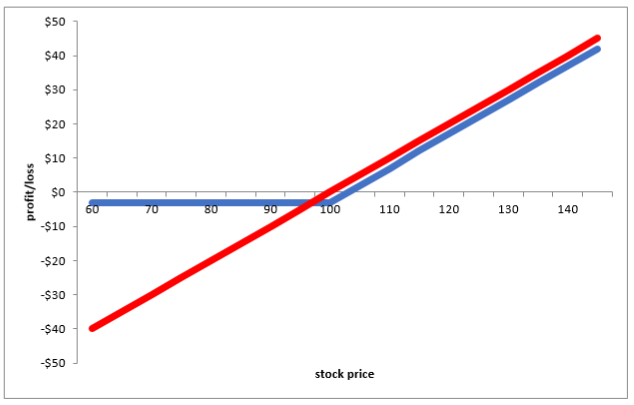

Here’s an example of how things can go wrong if you don’t understand option mechanics. Let’s say you bought a $100 call for $3, or a total of $300. On expiration Friday, the stock is trading for $99.50, and it looks like it’s going to expire worthless. Rather than paying the commission to close it out, you take off for the golf course. However, in the last few minutes of trading, news breaks out, and the stock closes above $100. Because you didn’t close out the option, you’re going to be long 100 shares of stock on Monday morning. Now let’s say the stock trades at $95 on the opening bell. You own shares at $100, but if you don’t want the shares in your account, you’re going to end up selling them for the current market price of $95. Therefore, you ended up with a $500 loss, even though you only spent $300 on the option. The reason this happens is the long $100 call has a limited downside risk of $3 – the amount you paid. It’s profit and loss diagram looks like a hockey stick as shown by the blue curve in the chart below:

However, if you end up exercising that call, whether intentionally or through automatic exercise, your profit and loss diagram is no longer represented by the blue curve. Instead, you’re now long shares of stock and have an unlimited downside risk as shown by the red line.

The lesson to learn is that if you have any long options that are even remotely close to becoming in the money at expiration, close them out. If your proceeds are not enough to cover commissions, most brokers will call it even. If your broker won’t, you can always place instructions to not exercise any long options that may end up going in the money. If you either close out the long positions or instruct the broker to not exercise them, now it’s safe to go to the golf course. Options aren’t risky if you understand all the rules. As Warren buffet said, risk comes from not knowing what you’re doing. If you understand the art and science of options trading, they’ll become invaluable tools for hedging risk and holding on for bigger gains.

Good Investing!

Bill Johnson, Steve Bigalow

and The Candlestick Forum Team

P.S. Bill Johnson’s Alpha Trader Options Course takes you from the very beginning, step-by-step, through an exciting journey into the world of options. At the end, you’ll have the necessary knowledge and confidence to start investing and hedging with options. In addition, you’ll have a rock-solid foundation from which to continue your options education.