Options Pricing: It’s Like Buying in Bulk

By Bill Johnson

One of the benefits of options is that we get lots of choices. We have lots of expiration dates, strikes, and strategies. Unfortunately, having so many choices also causes confusion among traders. Which expiration and which strike should you choose?

To answer that, it helps to understand some basics of options pricing. Most traders believe that at-the-money option prices follow a straight-line path. For instance, if a one- month option costs $1, you’d think a two-month option must cost $2 – twice the time, twice the money. It seems to make sense, but it’s wrong. Not understanding how options are priced leads traders to make bad strategy decisions.

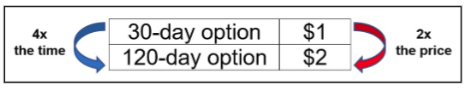

It’s counterintuitive, but here’s the way it works: If a one-month option costs $1, it would take a four-month option before you’d see it trading for $2. In other words, it takes four times the amount of time to double an option’s price. The reason is that options prices are proportional to volatility, which is proportional to the square root of time.

If you increase time by a factor of four, the option’s price increases by the square root of four, or a factor of two. If you can increase in option’s time to expiration nine-fold, the option’s price triples.

The point to understand is that when you’re buying long-dated options, it’s like buying things in bulk. Yes, you’ll pay more for the option, but the price per day is greatly reduced. For instance, the four-month option trading for $2 costs about 1.7 cents per day, but the one-month option trading for $1 costs about 3.3 cents per day – twice as much. If you’re buying options, you should lean toward buying longer-dated options as the amount of time value you’re spending per day is greatly reduced.

On the other hand, option sellers should lean toward selling shorter-term options multiple times rather than selling one longer-dated option. For example, if you’re using a covered call strategy, you may decide to sell the four-month option for two dollars. It sounds like a better deal since you’re receiving $2 rather than $1. However, you must wait the entire four months before you’ll collect it all. On the other hand, if you sell the one-month option four times, you’ll collect $4 – twice as much money for the same length of time.

Unfortunately, many new traders think longer dated options are riskier because they cost more money in total. However, you must always ask yourself how much am I paying per day? When you look at options in this light, longer dated options are always far cheaper. For a live example, Apple Computer (AAPL) closed today at $187.63. If you decided to sell the January 2019 $190 call (242 days to expiration), you’d receive $12.30. However, if you sold the $190 weekly that expires in four days, you’d get 54 cents. Instead, if you sold the 4-day call, you could do that 60 times during the same 242 days, which would net a total of $32 – far greater than $12.30.

There are other considerations, such as the size of the hedge. If Apple takes a big hit, you may have been better off having sold the longer-dated option. But all things being equal, you should buy longer-dated options and sell shorter-dated ones. The square-root pricing relationship is the reason. All options strategies are always about tradeoffs, so there’s never a crystal-clear answer as to what the best strategy may be. Instead, you want to focus on which strategy is best for you. Once you understand how options are priced, it puts you one step closer to mastering the art and science of options trading.

Good Investing!

Bill Johnson, Steve Bigalow

and The Candlestick Forum Team

P.S. Bill Johnson’s Alpha Trader Options Course takes you from the very beginning, step-by-step, through an exciting journey into the world of options. At the end, you’ll have the necessary knowledge and confidence to start investing and hedging with options. In addition, you’ll have a rock-solid foundation from which to continue your options education.