Bulls, Bears, and Beauty Pageants

By Bill Johnson

Stock traders have many choices of investments and an even bigger selection of technical indicators. However, they all share one thing in common: They rely on price movement, or volatility, for profit. The bigger the volatility, the bigger the price moves, the bigger the profits for the trader who is right – and the bigger the losses for the one who is wrong.

Options allow you to hedge volatility – or profit from it – by using a variety of strategies that allow you to partition risks and rewards in ways that cannot be done with shares of stock. That’s a big benefit, but to make it work, you can’t just approach the options based on whether you’re bullish or bearish. You must realize understand the role of volatility. However, even volatility poses a problem, as the price of options contracts don’t depend on whether the crowd is bullish or bearish. The price depends on what the crowd thinks the crowd thinks. To understand why, we need to look at an unlikely starting point – how to judge a beauty pageant.

The Economics of Beauty Pageants

In 1936, renowned British economist John Maynard Keynes explained price fluctuations in his masterwork, General Theory of Employment, Interest, and Money. There he drew the analogy that traders in a financial market make decisions much like participants of a beauty contest run by a local London paper at that time. The paper would run 100 photographs of women considered to be the most beautiful. Readers were asked to choose a set of six faces and everyone who picked the most popular face won a prize.

If you wanted to participate, it seems you should look through the photos and pick the six faces you think are the prettiest. However, a better “judge” wishing to win the contest wouldn’t use such a strategy. Instead, that reader will choose the six faces he suspects will be considered the prettiest by most of the people. But why stop there? A more sophisticated “judge” will take this reasoning into account and attempt to second guess the other judges’ second guessing – and so on and so on. Each level attempts to predict the selections based on the reasoning of other judges. As Keynes stated, “It is not a case of choosing those [faces] which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be.”

Keynes believed a similar process creates volatility in the stock market. Traders don’t price shares or options based on their fundamental or technical view, but instead on what they think everyone else thinks the value will be. It’s also why speculative bubbles can form. It’s not irrational to buy a “grossly overvalued” stock – if you feel everyone thinks the price will be even higher in the future. Asset valuation is a constantly moving target and that’s why prices can be so volatile.

This poses a problem for traders. As suggested by Keynes, to succeed at trading, you must be good at “mob psychology,” but that is a never-ending cycle of second-guessing the second-guesser. That’s the difficult and inconsistent way to invest. However, there’s a second choice that gives you more flexibility and consistency in your results, a choice that allows you to manage the inherent unpredictability of prices.

The Option Advantage

Options are the only assets that allows you to customize the risks you’re willing to accept. Most stock traders cut profits short because of the fear of holding the position. Trends generally last much longer than expected, and traders end up missing out on the many great rewards they set out to capture. Options help you to safely capture the missing money.

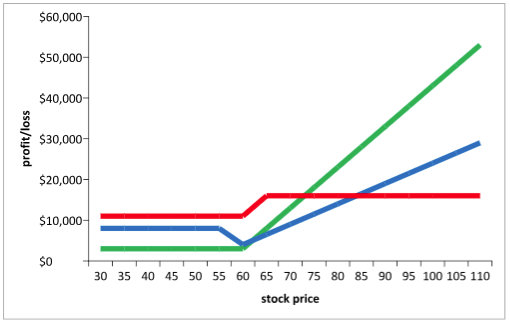

For instance, if buying call options, you can roll your call option up as the stock price rises. Doing so, you can roll your profit and loss curve above zero, as shown by the green curve in the chart below:

By having the entire curve sitting above zero, you can’t lose – but you may do better. On the other hand, what if you’re more fearful the stock price may fall? You may choose to leg into a backspread as shown by the blue curve. By entering a single trade, you can shift from the green curve to the blue curve. By sitting on the blue curve, you can make more money if the stock price falls, but it comes at the expense of fewer profits if the stock price rises.

If you want more profits if the stock price falls, you can shift from the green to the red curve. There’s now more profits if the stock price falls, but you have limited profits if it rises. The possibilities are endless, but you must understand the option advantage to easily switch as stock prices – and volatility – changes.

Richard Buckminster Fuller once said, “When I’m working on a problem, I never think about beauty. I think only how to solve the problem. But when I have finished, if the solution is not beautiful, I know it is wrong.”

Volatility poses a problem for stock traders. Options provide a beautiful solution.

Good Investing!

Bill Johnson, Steve Bigalow

and The Candlestick Forum Team

P.S. Bill Johnson’s Alpha Trader Options Course takes you from the very beginning, step-by-step, through an exciting journey into the world of options. At the end, you’ll have the necessary knowledge and confidence to start investing and hedging with options. In addition, you’ll have a rock-solid foundation from which to continue your options education.