Candlestick patterns are clear and easy to identify demonstrating highly accurate turns in investor sentiment. Japanese candlestick patterns consist of approximately 40 reversal and continuation patterns which all have credible probabilities of indicating correct future direction of a price move. However the twelve major candlestick patterns provide more than enough trade situations to most investors. There are only twelve major patterns that should be committed to memory but this does not mean that the remaining secondary patterns should not be considered. In fact those signals are extremely effective for producing profits. Reality however demonstrates that some of them occur very rarely.

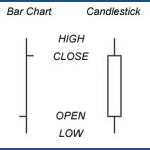

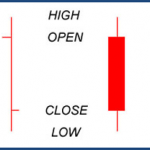

Candlestick trading analysis does not require knowing intricate formulas or ratios and it does not require massive amounts of education to effectively utilize the signals. The signals and patterns are easy to see as illustrated below. As you can see a stock price closing higher than where it opened will produce a white or green candle. A stock price closing lower than where it opened creates a black or red candle. The boxes that form are called “the body” and extremes of the daily price movement are represented by the lines extending from the body. These lines are called shadows or tails. When a stock price closes where it opened or very close to where it opened, it is called a “doji.” A hollow candle forms when the stock closes higher than its opening price and a solid (or filled) candle forms when the stock closes lower than its opening price.

The twelve candlestick patterns illustrate the major signals. The definition of “major” means two things. First, they occur in price movements often enough so that they are beneficial to producing a supply of profitable trades. Second, they clearly indicate price reversals with strength enough to warrant placing trades. The twelve major candlestick patterns are listed below and as you can see each candle formation has a unique name. Some have Japanese names while others have English names.

Twelve Major Candlestick Patterns: Doji, Bullish Engulfing, Bearish Engulfing, Hammer Signal and Hanging Man, Piercing Pattern, Dark Cloud Cover, Bullish Harami, Bearish Harami, Morning Star, Evening Star, Kicker Signals (Bearish and Bullish), Shooting Star, and Inverted Hammer.

The average investor does not have to be dependent on the investment professional when utilizing candlestick patterns. Professional recommendations are not always in your best interest at the forefront. Whether totally unfamiliar with investment concepts or very sophisticated in investment experience, the Japanese Candlestick trading formations are easily utilized. The signals and patterns are easy to see and their interpretations are reliable.

Continue to read about the Doji which is one the most revealing candlestick signals.

Click here to learn how you can Profit ‘Big-Time’ From Trading With Candlesticks

Learn more about the member benefits included in my Candlestick Forum Membership package.

[…] Candlestick trading signals consist of approximately 40 reversal and continuation patterns. All candlestick patterns have credible probabilities of indicating correct future direction of a price […]